Disclosure: We may earn a commission or fee from some of the links in our content. However, this does not affect our recommendations. Learn more.

Sick of trying to dispute chargeback requests on your own? This Chargeflow review will show you how you can automate and streamline the process in no time.

Dropshipping makes it easier to launch and run an online business in a lot of ways.

It eliminates the need to manufacture, store and ship your own products, and allows you to experiment with a huge inventory of items with minimal risk.

But that doesn’t mean dropshippers don’t face some of the same challenges as standard ecommerce companies: like chargeback for instance.

Chargeback claims can easily drain your profits, and harm your company’s reputation, and managing disputes is notoriously difficult for a lot of vendors.

That’s where Chargeflow comes in, giving you an opportunity to minimize chargeback issues with automation, AI, and machine learning.

I put Chargeflow to the test; to find out just how beneficial it might be for dropshipping brands.

Quick Verdict, Pros and Cons

Chargeflow is an intuitive, user-friendly solution that can genuinely help dropshipping businesses minimize chargeback issues, and maintain more of their profits.

It has an excellent reputation among vendors already, with a 4.8 out of 5 star rating on the Shopify app store.

However, it does have some high fees which might deter certain dropshippers.

Pros:

- No upfront fees or set-up costs

- 100% automation for chargeback management

- Integrations with Shopify, Stripe, PayPal, and more

- Excellent, easy-to-use app

- Fantastic security and best-in-class SSL encryption

- Enterprise options available for larger companies

Cons:

- Commission fees can be high for small stores

- Doesn’t integrate with all payment gateways

What is Chargeflow and How Does it Work?

Chargeflow is a straightforward tool that combines automation, artificial intelligence, and machine learning to transform the way dropshippers (and other merchants) handle chargeback disputes.

It boasts exceptionally high win rates, surpassing the results of countless other chargeback management services and systems.

When a customer initiates a chargeback after placing an order with your company, Chargeflow gets to work instantly capturing dispute claims from your connected payment processor.

It then calculates a “ChargeScore” for the dispute, based on factors like your account history, fraud analysis, and evidence strength, to help you identify your chances of a successful dispute.

If you want to argue against the chargeback claim, ChargeResponse pulls evidence from more than 50 data points, including third-party databases, and ensures you have all the evidence you need to (hopefully), prevent your customer from reclaiming their money.

The great thing about the whole experience is you don’t have to anything.

Chargeflow automates everything for you, and doesn’t charge you anything upfront. You only pay a small fee after Chargeflow helps you win a dispute.

The Core Chargeflow Features

Chargeflow is a tool that’s hyper-focused on one thing: winning chargeback disputes.

It’s not packed with too many “extra” features. Instead, it just gives you the tools you need to manage chargeback requests more effectively. Here’s what you get built into the platform.

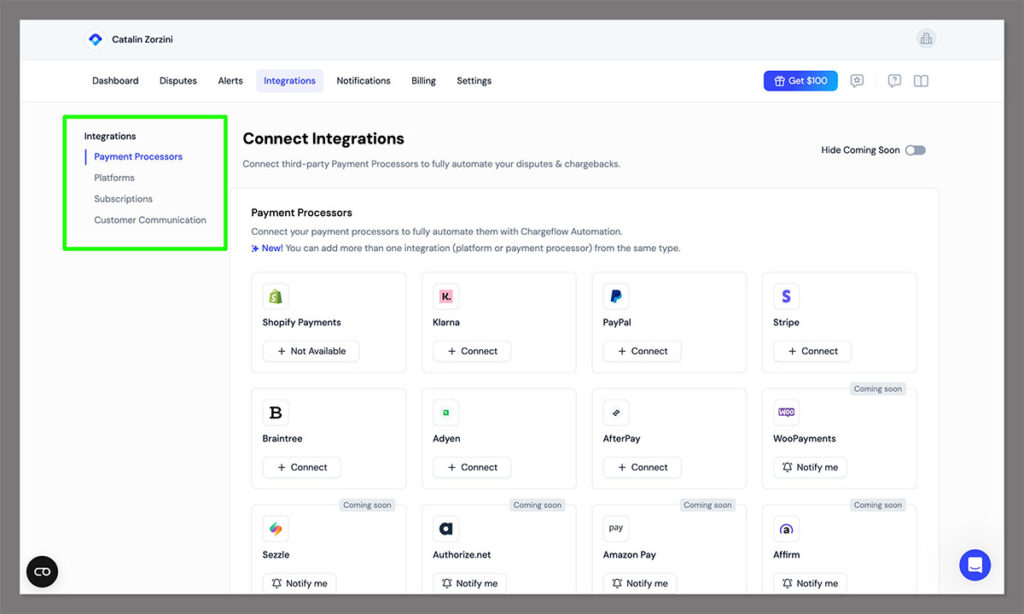

Integrations with Stores and Payment Processors

One of the things I love about Chargeflow, is how easy it makes it to integrate your online store, and chosen payment processing solution with the software.

All you need to do is click a few buttons, and you can add Chargeflow to Shopify, PayPal, Stripe, and a range of other tools.

The solution even integrates with buy-now-pay-later systems like Klarna and Afterpay.

Once you’ve created the connection, data automatically syncs between the two systems without you having to do anything. There’s no need to upload any CSV files, or manually sync dropshipping data.

The Chargeflow App

The Chargeflow app is basically the central hub where you can manage all of your Chargeback disputes, track your success rates, and access in-depth analytics.

You can monitor things like how many disputes you’ve received from different channels (like Stripe or PayPal).

I really like the fact that Chargeback also automatically identifies products that receive the most chargeback requests, and top “reasons” for disputes.

For instance, you can see whether the main reason for a charge back on a specific product is that the item wasn’t “as described”.

This can help you to decide whether you might want to reconsider working with a specific dropshipping partner.

Within the app, you also get to choose exactly how “involved” you want to be in the dispute process.

For instance, you can get Chargeflow to automate everything from generating responses, to matching the dispute to the order on your ecommerce platform.

Alternatively, you can decide to handle certain things, like adding your own data, yourself.

ChargeScore and ChargeResponse

ChargeScore, and ChargeResponse are two of the core features Chargeflow uses to help you automatically handle any Chargeback requests with minimal issues.

ChargeScore is the AI system that analyzes your account’s history and data to help you see immediately whether you have a good chance of actually winning a chargeback dispute.

Depending on the “score” you see, you can ask Chargeflow to use the “ChargeResponse” system to automatically gather all of the data you need to submit to a payment processor.

It gathers information from 50+ different data points, runs that data through a set of proprietary machine learning and artificial intelligence algorithms, and creates a response instantly.

After ChargeResponse generates your response, you can customize everything, adjusting the template with a convenient drag-and-drop toolkit that allows you to add paragraphs, images, logistics information, past charge details, and more.

You can even automatically match order details from a site like Shopify to the Chargeback Response, making it easy to create a more compelling argument in seconds.

Chargeflow Alerts

Chargeflow Alerts keep you up-to-date on potential issues that might lead to chargebacks, so you can potentially stop them from happening in the first place.

Before chargebacks occur, they typically start life as disputed transactions.

Chargeflow gets an instant notification from your connected payment processor, so it can offer you an opportunity to take corrective actions instantly.

This system works with almost all major credit card companies and processors, such as Stripe, Braintree, and PayPal.

Plus, like other Chargeflow features, it allows you to hand the process of “preventing” issues over to the Chargeflow team, so you don’t have to handle anything yourself.

Chargeflow can automate refunds, and allow you to not just avoid chargeback fees, but also protect your brand’s reputation with payment processors, so you’re less likely to encounter issues like a processor “freezing” your account.

The only downside is that this feature doesn’t come for free. You will need to pay a flat fee per alert – but you only pay that when Chargeflow successfully prevents chargebacks from happening.

Chargeflow Review: Dispute Automation

The main purpose of Chargeflow is to automate and simplify chargeback management on behalf of businesses.

For dropshippers, it offers various convenient integrations that make it easy to handle the varied dispute processes of different companies, such as:

PayPal Chargeback Automation

If you’ve ever had to handle a dispute with PayPal, you’ll know how complicated it can be.

There’s even more work involved here (usually) than dealing with a standard chargeback. Fortunately, Chargeflow’s PayPal automation solution deals with everything for you.

It’s actually the only system available right now that can handle PayPal issues for companies completely.

All you need to do is integrate Chargeflow with PayPal, and the system will gather, analyze, and submit data for disputes automatically.

There’s no need to waste time on back-and-forth messages with customers and PayPal, or manually escalate disputes.

Chargeflow, and its AI tools deals with everything – unless you decide you want to take over (which you can do at any time).

Stripe Chargeback Automation

The Stripe chargeback automation service is similar to the one offered for PayPal.

Stripe’s dispute and chargeback process is very different than the one you’ll go through with PayPal, but with an integration for Chargeflow, you don’t have to worry about dealing with it yourself.

As an official Stripe partner, Chargeflow can easily leverage the Stripe app platform and automate chargeback management on your behalf.

Once again, you can choose to personalize your responses and add your own data if you prefer too.

Shopify Payments Chargeback Automation

Since Chargeflow also directly integrates with Shopify, it can also fully automate the process of handling chargebacks for stores using Shopify Payments.

Again taking advantage of this capability is the same as using any other Chargeflow integration.

You simply connect your Chargeflow account to Shopify, and Shopify Payments, and every time you receive a chargeback notification, Chargeflow will jump into action for you.

How Much does Chargeflow Cost

If you’re trying to keep the costs of running your dropshipping store as low as possible, Chargeflow is a great option.

You don’t actually have to pay for anything upfront. Instead, you only pay when Chargeflow actually delivers results.

There are two plans to choose from for the basic Chargeflow features, including 100% automated chargeback management.

The first is the “Success” plan, which charges you a 25% fee (based on the value of the chargeback), every time a dispute is settled in your favor.

The second option is the “Enterprise” plan – which is a fully customizable solution designed to serve larger businesses.

This comes with end-to-end fraud support, SSO and user provisioning, custom API integrations, and an account manager. You’ll have to contact the team for the price.

The only other fee to consider is the fee for “Chargeflow Alerts”, mentioned above. Every time an alert from Chargeflow helps you to avoid a chargeback, you’ll pay a flat $30 fee.

This could be excellent value for money, particularly if you’re selling high value dropshipping products.

Chargeflow Review: The Verdict

Ultimately, chargeback requests are a real problem for dropshipping organizations.

They can stop you from scaling your business, eat into your profits, and even harm your relationships with payment processors, making it harder to accept different payment methods in the future.

Chargeflow makes it simple to not only win chargeback disputes automatically, but prevent them from happening.

You can even access insights that might help you to determine which dropshipping vendors you shouldn’t be working with (based on the number of chargeback requests made).

If you’re looking for a convenient way to simplify chargeback management, and make more data-driven decisions for store growth, Chargeflow is definitely worthwhile.