Disclosure: We may earn a commission or fee from some of the links in our content. However, this does not affect our recommendations. Learn more.

A retailer practice that’s been in existence for more than a century, private label branding has long been a means of boosting sales, reducing costs, improving quality, inspiring loyalty and raising competitiveness.

Private label products bear a retailer’s brand but are mostly manufactured by a third party (some retailers handle the production themselves).

Also referred to as store brands, inhouse brands, house brands, own brands or own store brands, they stand in contrast to national brands (also called name brands or premium brands).

Consumers that opt for private label products often do so for the lower cost, higher quality and better value proposition overall when compared to national brands.

Private Label Methods

Private label brands are usually deployed in one of three ways:

- Entire lines of products each bearing a distinct brand name (all different from the store’s) and centered around a particular feature or category (e.g. Kroger’s Private Selection, Comforts for Baby and Simple Truth).

- A distinct name but carried by most or all of the store’s own label products (e.g. Costco’s Kirkland Signature and Whole Foods’ 365 Everyday Value).

- Most or all products bear the store’s name (e.g. Trader Joe’s, Publix and Wegmans).

Private Label Penetration

Penetration varies from country to country. It is highest in Europe where, in countries such as Switzerland, Netherlands and Spain, 40-50% of supermarket sales comprise private label brands. In the US, one in five products sold by retailers in the US are own store brands.

Private label success is not guaranteed. Retailers that have made it provide pointers on what strategies are likely to work and why. High penetration as a percentage of total company sales is still dominated by smaller format retailers such as Aldi. However, large stores are growing fastest partly due to their expansive footprint and name recognition.

We take a look at some of the most successful large private label brands in the US based on Numerator’s research.

Best Privale Label Brands

1. Aldi

In many stores, private label brands are a small part of the business. For the German multinational supermarket chain Aldi, private label products are the primary source of the company’s revenues in the US. In 2022, the company known for its ‘no-frills approach’ made nearly 78% of its sales from its own brands primarily in the grocery, household, health and beauty space. Roughly 9 in 10 products in Aldi’s stores are own store brands.

Considering its European roots (perhaps the global home of private labeling), this extraordinarily high proportion is no surprise. The company has bet on its private label strategy to accelerate its growth in the US, a departure from modern-day conventional practice where ecommerce is viewed as the quickest path for growth. Its store brands are some of the fastest growing in the country.

Aldi’s best known brands include Specially Selected, SimplyNature, Fit & Active, Little Journey, Baker’s Corner, Winking Owl and Stonemill.

2. Trader Joe’s

At just under 60% of US sales from its private label products, Trader Joe’s is the number one large homegrown retailer by penetration of private label sales in overall revenue. But while the California-based small store format grocery chain was founded in the US, it’s long been a subsidiary of Aldi. Perhaps a fitting explanation why its own store brand penetration is only second to its parent company’s.

Nevertheless, Trader Joe’s is a private label champion in its own right with a decades-long history of the practice. So much so that the brand considers its private label to have evolved into a national brand. The company is famously secretive about the manufacturers and suppliers it works with though several have come to light through product recalls.

Trader Joe’s products appeal to different people for different reasons. For example, the company has an established reputation for shunning artificial flavors, synthetic colors and genetically modified (GMO) sources.

3. Wegmans

With a cult-like following, the New York-based grocery chain known for its suburban shopping experience has a store brand penetration of just under 50%. Wegmans has grown its store brands to over 17,000 products covering everything from healthy snacks and frozen vegetables, to prepared meals and deli.

Wegmans customers that opt for its private label products do so for the value proposition that balances quality and affordability. With Wegmans though quality (and not affordability) is the attribute that’s more associated with the brand. This is complemented by the company’s lengthy reputation for providing stellar customer service.

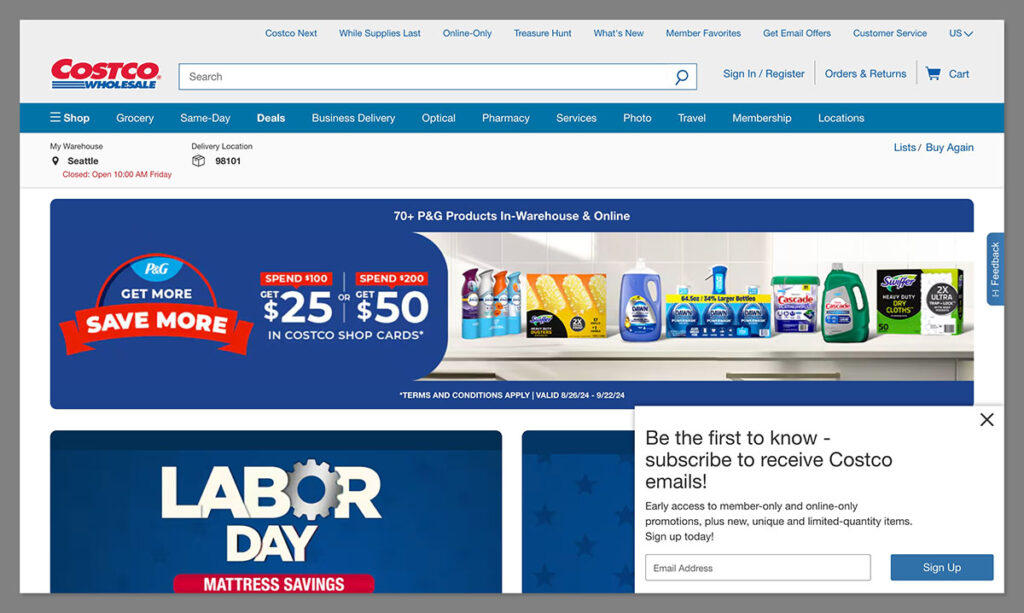

4. Costco

Costco’s success is hinged on its private label brand, Kirkland Signature. Kirkland Signature is responsible for about a third of the wholesale warehouse chain’s total sales volume and a quarter of sales value. Some consider it a textbook example of a private label brand that outcompetes national brand rivals.

With annual sales in excess of $60 billion, Kirkland Signature is by far the largest CPG store brand – Walmart’s total private label business may be bigger but it comprises multiple brands with Great Value being the largest at about $30 billion. The size of Kirkland Signature’s annual sales exceeds the revenue of all but half a dozen global CPG giants such as Nestle, Pepsico, Unilever and Procter & Gamble.

Kirkland Signature has a loyal customer base that buys everything from branded apparel to consumer packaged goods. Costco’s overarching own store brand strategy is founded on pricing, quality and enhancing the customer experience.

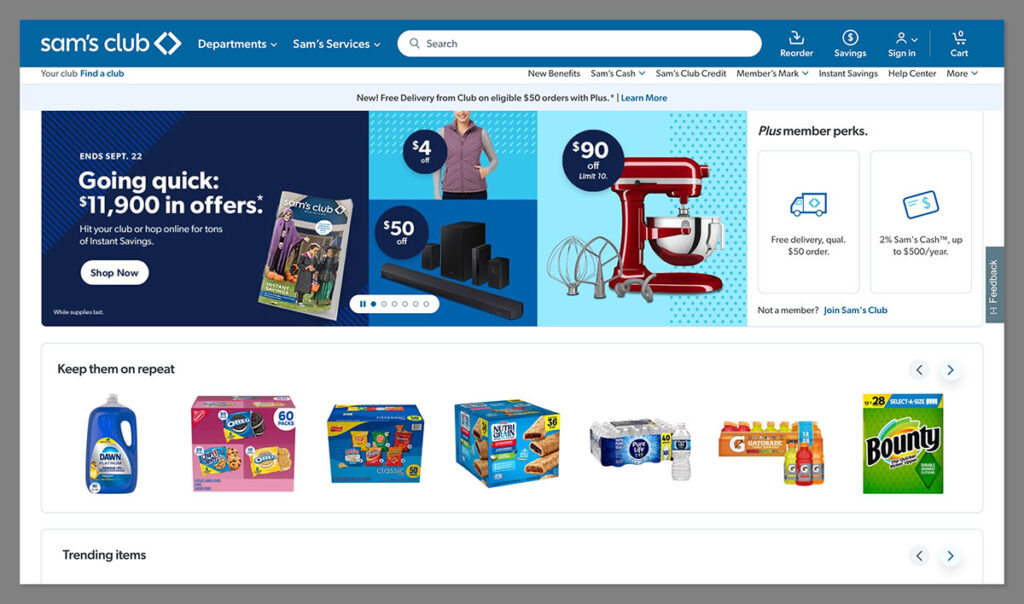

5. Sam’s Club

Walmart’s members only division, Sam’s Club, runs a chain of warehouse retail stores not too different from Costco’s. Much like its main rival’s as well as Trader Joe’s, Sam’s Club moved to combine its various private brands under a single name a decade ago. Hundreds of products are now sold under its own store label, Member’s Mark. It has enjoyed considerable success with private label sales now at 30% of total sales. Further, Member’s Mark has a 26.5% household penetration in the US (number of households that buy its products) and was Store Brands’ 2023 Retailer of the Year.

As part of the Walmart family, Sam’s Club enjoys some important product sourcing advantages allowing it to negotiate supplier terms jointly with its parent company.

It has embarked on a strategy of sustainable and environmentally friendly business by removing dozens of ingredients from its consumable and food products including formaldehyde and aspartame. In this respect, Sam’s Club has renovated, reformulated and relaunched more than 1,000 products over the last three years.

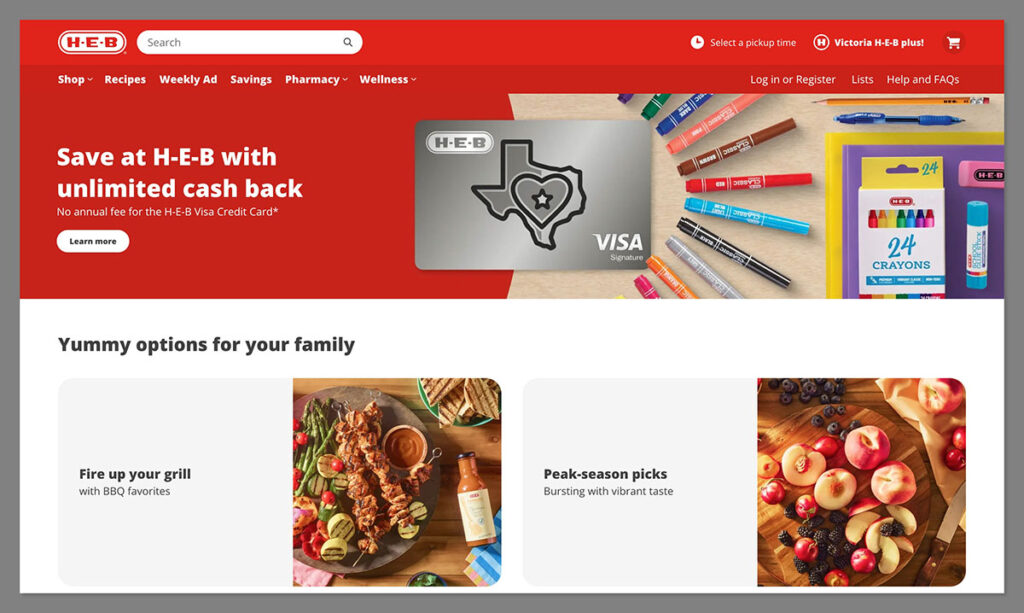

6. H-E-B

H-E-B (short for H.E. Butt Grocery Co.) is sometimes considered the largest supermarket that most everyday Americans have never heard of. That is despite launching in 1905 and generating more sales annually than well-known chains such as Trader Joe’s, Aldi and Dollar Tree (and earning as much revenue as Dollar General). Its invisibility primarily stems from its complete focus on Texas – it does not have any stores in any other state in the US (it does have a presence in Mexico).

About 27% of its sales come from its own store brands. H-E-B’s private label strategy has stood out from its peers for its blend of exceptional savings, superior quality and hyper-local product selection. Customer surveys regularly rank it among stores whose brands are best suited for saving money. Another key selling point is the emphasis on the Texas connection. From Texas-shaped tortilla chips and cheese chunks, to coffee blends named Austin and San Antonio. The Texas sentiment is hard to miss at its stores.

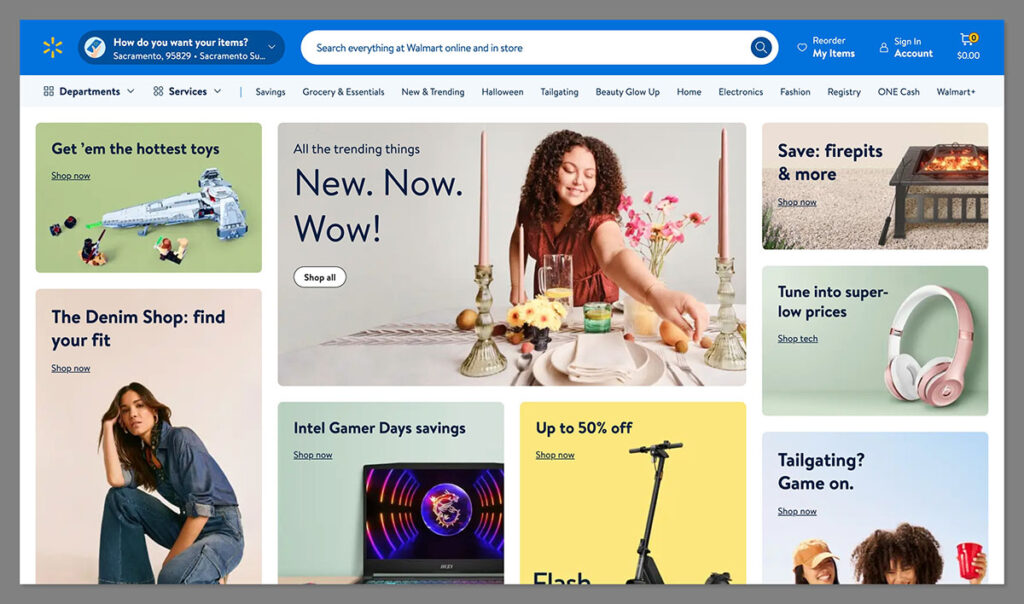

7. Walmart

Walmart launched its first own store brand in 1980. Today, its private label business does not have as high a penetration in its total sales as Aldi, Trader Joe’s or Wegmans. But the sheer scale of its business means that just over 23% of sales from private labels translates to a volume and value that surpasses virtually everyone else’s. In fact, two in five purchases of store branded packaged goods online in the US occurred on Walmart.com.

In line with the giant retailer’s price-driven strategy that leverages its unrivaled scale, Walmart’s private label products are primarily positioned as a lower cost alternative to expensive national brand goods. It’s a strategy that seems to be paying off. Notable Walmart store brands include Great Value, Equate, Marketside and Freshness Guaranteed, all of which ranked as the best performing by total sales value in the US.

8. Kroger

Kroger is the largest grocery store chain in America. It has more than a dozen inhouse brands of groceries and consumer goods including The Kroger (its largest), Private Selection, Comforts for Baby, Simple Truth, Mercado, Heritage Farm and Smart Way. In 2022, the company collapsed 17 of its legacy store brands into just two – Heritage Farm (for dairy and fresh product) and Smart Way (for nonperishable goods). Smart Way was one of the fastest growing own store brands in the US in 2022.

Like fellow giant retailer Walmart, buyers view the primary advantage of Kroger’s private label products as their lower pricing compared to national brands. This has seen store brand sales grow quicker during periods of unusually high rates of inflation. Nevertheless, a few of its brands, such as Private Selection, are positioned as premium products.

While Numerator’s research placed Kroger’s store brand penetration at just over 22%, the retailer disputes the numbers and claims it is considerably higher at 27%. Its household penetration in the US stood at about 31% in the first of half of 2022.

9. Meijer

Despite having half of its stores located in its home state of Michigan, Meijer is a top 25 retailer in the US by revenue. Just as impressive is that the company has achieved notable success in its private label division. Nearly 16% of Meijer’s sales are from own store labels. Among its most notable inhouse products include Fredrik (a premium brand), Crafted Market (for heat and eat food) and Tranquil & True (for sleepwear and intimates).

Best known for its supercenters, Meijer launched a smaller format store type in 2023, Meijer Grocery, targeting a higher income audience than its traditional customer segment. The company is likely looking forward to replicating or accelerating its private label success within this new store format.

10. Hy-Vee

An employee-owned grocery chain established nearly a century ago, Hy-Vee has over the past 30 years regularly made the list of the top grocery chains and retailers in the US. Its store brands have proved to be an important cog in the company’s past success, current growth and future plans. It rolled out its first store brand in the early 80s and has only grown its portfolio since.

Among the dozens of private label product lines in its stable include HealthMarket, TopCare, Full Circle, Over the Top, Paws and Hy-Vee itself. With store brand products accounting for 15% of all sales, Hy-Vee’s strategy balances attractive pricing (its inhouse brands typically cost 15-30% less than national brands) with the consumer’s desire for healthy, high quality items.

11. Target

Target introduced its first own brand food in 1995 – Archer Farms – before venturing into other categories such as household goods, kids apparel and electronics via Room Essentials, Cat & Jack and Heyday respectively. Target’s success likely inspired many large retailers to follow suit (or do so more aggressively) such as Walmart, Bed, Bath & Beyond, and Macy’s. Today, the company has about 50 private brands with at least 10 raking in a billion dollars in sales annually. One of its newest, the active wear and sporting goods brand All in Motion, generated a billion dollars in its first year.

The retailer has in more recent times embarked on an overhaul of its private label strategy. It has phased out older lines like Simply Balanced and Archer Farms, and replaced them with Good & Gather. Target has also introduced new household essentials lines like Smartly and Everspring to complement its already established Up&Up.

Good & Gather and Up&Up are among the top 15 most popular own store brands in the US by household penetration. More than Magic, Everspring, Smartly and Favorite Day are some of the fastest growing private label brands.

12. Amazon

At just 1% of its total sales, Amazon has a much smaller proportion of its revenue drawn from private label brands compared to the other retailers on this list. However, as the largest ecommerce store in the US, it deserves a mention. Further, its private label brands are growing rapidly with some segments surging double digit year-on-year. Also, the total store brand penetration masks great variation between product segments – it’s higher in consumer electronics, home goods and clothing.

Today, the giant e-retailer has more than 100 own store brands available on the site, the largest range of any retailer. Private label products include Amazon Essentials, Amazon Basics, Amazon Aware, Amazon Elements, Simple Joys by Carter’s, Wonder Bound, Happy Belly, Mama Bear, Presto, Basic+Care, Kitzy, Goodthreads and Lark & Ro. You can usually tell an Amazon private label product by an ‘Amazon Brand’ label in the item’s name and/or description.

Amazon’s private label has been the subject of controversy and antitrust investigation with leading politicians criticizing its role as both being a marketplace and a direct seller on this marketplace. The company has taken a number of measures to reduce the impression of a direct contest between it and name brands. However, this is unlikely to provide much reprieve from criticism by lawmakers and manufacturers.

13. Publix

Publix has a decades-long history of private label brands, a past that has allowed the company to gradually perfect its store brands’ strategy. Its products are built to meet the aspirations and desires of its customers – quality, value, distinction and personalization. More than 13% of its sales are derived from its own brands.

That said, the employee-owned south-eastern supermarket chain takes a different position from many of its peers by positioning quality as the number one advantage of its inhouse products. While it does work with third-party suppliers, Publix has its own production facilities for several products including dairies, fresh food operations and a deli kitchen.

Wrapping Up

Historically, private label brands were perceived as cheap knockoffs one would go for because they could not afford higher quality national brands. That is changing as not only stores become more adept at driving quality production but also at differentiating their products from what’s already on the market.

In any case, large retailers enjoy economies of scale and, in the case of brick-and-mortar stores, a sizable geographical footprint. They are in an ideal position to set a low price point and still run at a profit thanks to the high volume.